Click inks to expand menu

Public Works / Construction Projects

In California, prevailing wage laws and the Department of Industrial Relations (DIR) play an essential role in ensuring fair compensation for workers involved in public works projects. These rates are

determined based on various factors such as location, type of work, and job classification.

For some government contracts in CA, agencies require contractors to provide proof of CA DIR registration. Public works contractors can register or renew for one, two, or three fiscal years (July 1-June 30) for a fee of $400, $800 or $1,200

https://www.dir.ca.gov/Public-Works/Contractor-Registration.html

Prevailing wage rates can differ across counties and can change periodically, so it is essential to stay up-to-date with the latest information.

Here’s a brief explanation of each:

To find the list of hourly rates for professional services in California, you can refer to the DIR’s website, specifically their Prevailing Wage Determinations page, which provides the prevailing wage rates for various job classifications:

https://www.dir.ca.gov/OPRL/PWD

Here are the steps to access the prevailing wage rates for professional services:

You will then see the prevailing wage rate for the selected professional service in the specified county.

Keep in mind that this information is subject to change, so always refer to the latest determinations on the DIR website before entering into contracts or submitting bids for government projects. Additionally, be aware of any federal prevailing wage requirements under the Davis-Bacon Act if the project is federally funded or connected to federal funding.

Federal prevailing wages are the minimum hourly wages, including benefits and overtime, that contractors and subcontractors must pay to their employees working on certain federally-funded or federally-assisted construction projects. These wages are determined by the U.S. Department of Labor (DOL) and are based on the wages paid to workers in similar trades within a specific geographic area.

The primary federal law governing prevailing wages is the Davis-Bacon Act of 1931. The Davis-Bacon Act applies to contracts for construction, alteration, or repair work in excess of $2,000, where the United States or the District of Columbia is a party. The act aims to ensure fair compensation for workers and prevent the exploitation of labor on government-funded projects.

Here is an overview of how federal prevailing wages work:

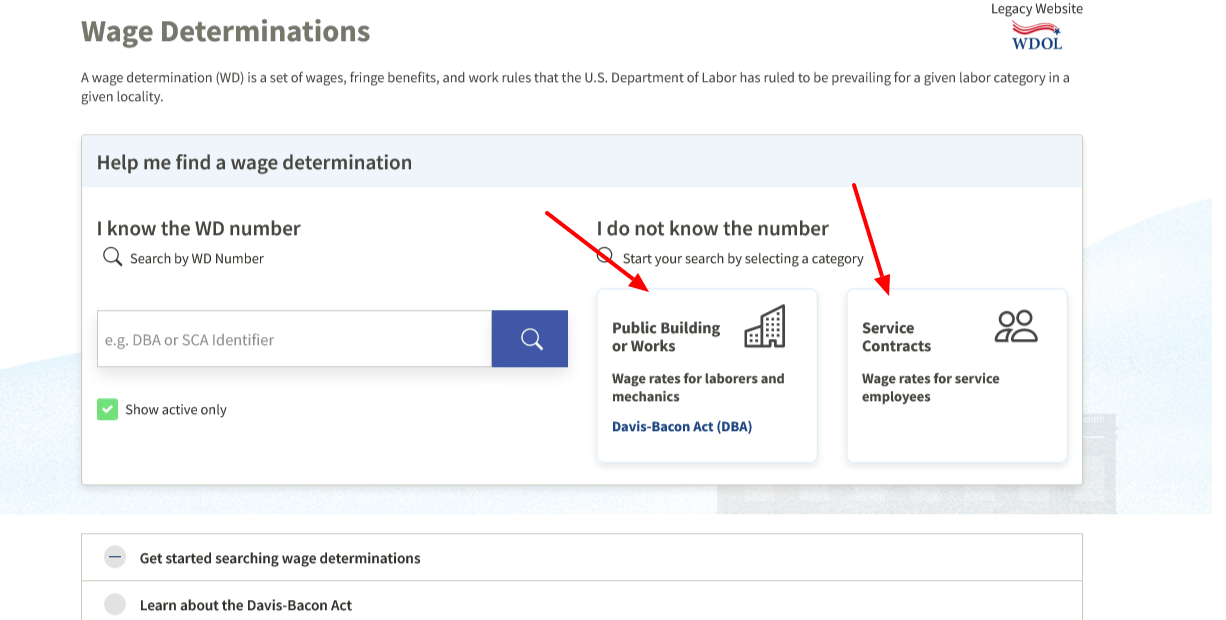

Wage Determinations: The DOL’s Wage and Hour Division (WHD) establishes prevailing wage rates for various job classifications in the construction industry. These wage rates are called wage determinations and are based on surveys conducted by the DOL in specific geographic areas. Wage determinations are published on the DOL’s website and can be accessed through the Wage Determinations Online (WDOL) system: https://sam.gov/content/wage-determinations

IMPORTANT STEP – Choose one, then apply filters on the left side of the page.

Contract Requirements: Contracts subject to the Davis-Bacon Act must include a provision specifying the prevailing wage rates for the project. Contractors and subcontractors are required to pay their employees at least the prevailing wage rates established by the DOL for each job classification.

Compliance and Enforcement: Contractors and subcontractors must maintain payroll records for their employees, demonstrating compliance with prevailing wage requirements. The DOL is responsible for enforcing compliance with the Davis-Bacon Act and has the authority to investigate potential violations. Penalties for non-compliance can include contract termination, withholding of payments, and debarment from future federal contracts.

Related Acts: In addition to the Davis-Bacon Act, other federal laws also address prevailing wage requirements for different types of projects. For example, the Service Contract Act (SCA) establishes prevailing wage rates for employees working on federal service contracts, while the Davis-Bacon Related Acts (DBRA) extend prevailing wage requirements to certain federally-assisted construction projects.

It is important for contractors and subcontractors to familiarize themselves with the specific prevailing wage requirements that apply to their projects, as these requirements can vary depending on the nature of the project and the source of its funding.

CMG Certified Contractor Support

Technical questions about an Opportunity, FOIA, RFP Analysis, etc…

CMG Alliance is committed to providing quality through professionalism, a team approach, and effective problem solving methodologies to ensure our clients receive the best government contracting experience with focus on results and winning contract awards.

CMG Alliance: A Government Contracting and Business Consulting Firm. All Rights Reserved, 2024 | Privacy Policy

Site credit: afterdarkgrafx.com